Bank Verification Number (BVN) is a unique identification number issued to every bank account holder in Nigeria. This number helps to enhance security and reduce fraudulent activities across the banking sector. Understanding how to check your BVN is crucial for managing your bank accounts efficiently, ensuring that your financial transactions remain secure. In this comprehensive guide, we will explore the various methods available for checking your BVN, the importance of maintaining its confidentiality, and the potential benefits it offers.

Checking your BVN is a straightforward process that can be done through multiple channels. Whether you prefer to use your mobile phone, visit a bank branch, or access online banking platforms, there are convenient options available for everyone. It's essential to know your BVN, as it is required for several banking services such as opening new accounts, applying for loans, and making high-value transactions. By familiarizing yourself with the BVN checking procedures, you can ensure a seamless banking experience.

In addition to providing a secure identification method, the BVN system plays a significant role in promoting financial inclusion in Nigeria. It allows banks to verify the identity of their customers, reducing the risk of identity theft and fraud. As you navigate through the process of checking your BVN, you'll also gain insights into how this system works and the reasons why it is an integral part of Nigeria's financial infrastructure. So, let's dive into the details and empower you with the knowledge to manage your BVN effectively.

Table of Contents

- What is BVN?

- Why is Your BVN Important?

- How Can You Check Your BVN?

- Check BVN via SMS

- Check BVN Online

- Check BVN at the Bank

- Check BVN Using Mobile Apps

- Can You Change Your BVN?

- What to Do If You Forget Your BVN?

- Is It Safe to Share Your BVN?

- How to Protect Your BVN?

- Benefits of Having a BVN

- Challenges Associated with BVN

- Future of BVN in Nigeria

- Frequently Asked Questions About BVN

What is BVN?

The Bank Verification Number (BVN) is a biometric identification system implemented by the Central Bank of Nigeria (CBN) to curb and reduce illegal banking transactions in Nigeria. It serves as a universal ID among all banks in the country, enabling them to identify customers and protect their accounts from theft or fraud. It is an 11-digit number that is unique to each individual and is linked to all bank accounts owned by that person.

Why is Your BVN Important?

Your BVN is crucial for several reasons:

- It provides a unified identity across all Nigerian banks, reducing the risk of multiple identities.

- It enhances the security of your bank accounts by preventing unauthorized access and transactions.

- It is required for various banking operations such as opening new accounts, processing loans, and conducting large transactions.

How Can You Check Your BVN?

There are multiple ways to check your BVN, each offering convenience and accessibility based on your preference. Below, we outline the different methods available:

Check BVN via SMS

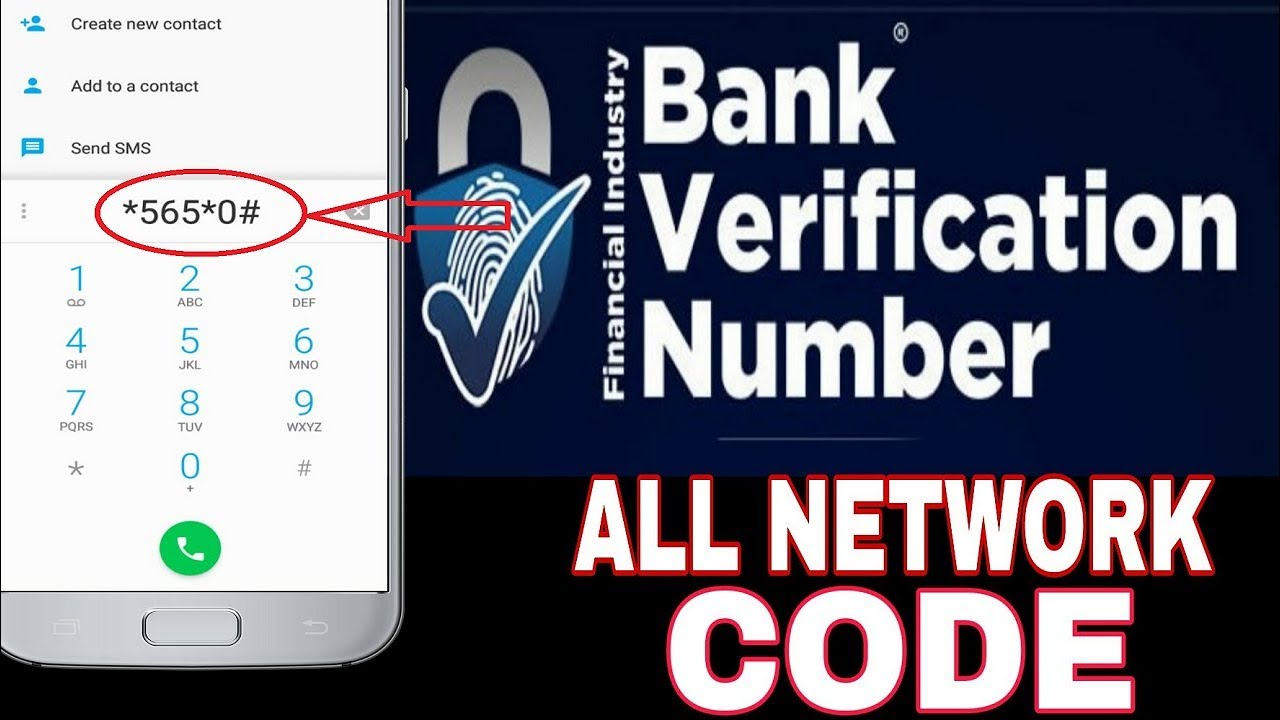

To check your BVN via SMS, follow these steps:

- Ensure you have the phone number linked to your BVN handy.

- Dial *565*0# on your mobile phone.

- Wait for the BVN to be displayed on your screen. Note that network charges may apply for this service.

Check BVN Online

Some banks offer online platforms where you can check your BVN. This usually requires logging into your bank's online portal and navigating to the BVN section. Ensure you have an active internet connection and your login credentials ready.

Check BVN at the Bank

If you prefer a face-to-face interaction, you can visit any branch of your bank. The customer service representatives will assist you in retrieving your BVN. Ensure you carry a valid form of identification such as your national ID card or passport.

Check BVN Using Mobile Apps

Many banks have mobile applications that allow you to check your BVN. Simply download your bank's app from the app store, log in with your credentials, and navigate to the BVN section.

Can You Change Your BVN?

No, you cannot change your BVN. The BVN is a permanent identifier linked to your biometrics and cannot be altered. If you suspect your BVN has been compromised, contact your bank immediately for guidance on securing your accounts.

What to Do If You Forget Your BVN?

If you forget your BVN, you can retrieve it by:

- Dialing *565*0# from the phone number linked to your BVN.

- Logging into your bank’s online banking platform or mobile app.

- Visiting your bank branch for assistance.

Is It Safe to Share Your BVN?

Your BVN is a sensitive piece of information and should be kept confidential. Avoid sharing it with unauthorized persons or on insecure platforms. Only provide your BVN when dealing with verified and trusted entities.

How to Protect Your BVN?

To ensure the safety of your BVN:

- Do not share it with untrusted sources or on unverified websites.

- Be cautious of phishing scams and fraudulent calls requesting your BVN.

- Regularly monitor your bank statements for any unauthorized transactions.

Benefits of Having a BVN

Having a BVN offers several benefits, including:

- Unified identity across all Nigerian banks.

- Enhanced security for banking transactions.

- Access to a wide range of financial services and products.

Challenges Associated with BVN

While the BVN system provides numerous advantages, there are some challenges:

- Limited awareness among some bank customers about its importance and usage.

- Potential for identity theft if the BVN is not adequately protected.

- Technical issues during the registration or verification process.

Future of BVN in Nigeria

The BVN system is expected to evolve, with plans to integrate it with other national identification systems. This will further streamline the identification process and enhance security across various sectors. Continuous efforts are being made to increase public awareness and adoption of the BVN system.

Frequently Asked Questions About BVN

Here are some common questions and answers about BVN:

- What is the cost of obtaining a BVN? BVN registration is free of charge.

- Can a minor have a BVN? Yes, a minor can have a BVN if they have a bank account.

- Is it possible to have multiple BVNs? No, each individual is entitled to only one BVN.